ETHCC[8] – Executive Summary

Date Posted: July 14, 2025

Event Overview

ETHCC 2025 brought together over 6,400 builders, investors, and crypto thinkers in Cannes, France. Across four packed days and nearly 400 talks, one thing was clear: Ethereum isn’t just evolving—it’s taking shape as the backbone of a new financial system. Talks covered the rise of AI agents, the risks and rewards of restaking, and the tools making DeFi simpler and safer for everyone. This summary breaks it all down by theme.

AI Agents & Automation in DeFi

ETHCC showed us where we’re headed: DeFi run by smart, self-operating AI agents. These aren’t tools; they’re becoming the users.

- Audrey (Nanopanda) explained how AI agents are replacing APIs. They interact with protocols directly and handle transactions without anyone watching. That means faster, always-on execution and fewer middlemen. With proper incentives, these agents could outcompete centralized trading bots. These systems are lean, self-adjusting, and immune to fatigue. They’re also capable of scaling globally without needing human oversight, making them ideal for borderless finance.

- Jonathan (Aleph Cloud) talked about agents with no human oversight. They run on confidential cloud systems, make their own decisions, and keep data private. These agents can fund themselves, set their own rules, and build persistent on-chain reputations. It’s the closest we’ve come to autonomous digital organisms. As they mature, they could take over everything from treasury management to liquidity provisioning.

- Sandy.X (Unstoppable Domains) imagined a future where these agents manage everything—your identity, your wallet, your DAO votes. It’s automated, secure, and free from bias. The user becomes the architect, not the operator. This radically shifts how we think about ownership and control. In this model, humans define rules once, and agents carry out policy forever.

- Yehia Tarek (Nethermind) showed how ERC-4337 lets AI customize your DeFi experience. It turns smart accounts into personal finance bots that optimize your moves. They can front-run inefficiencies and unlock new income sources without your input. For investors, it’s like having an always-on strategist in your pocket. These bots can evolve based on your portfolio, adjusting for risk tolerance and cash flow needs in real time.

Staking, Restaking & Yield Infrastructure

Ethereum’s yield game is getting more powerful—and more complex. These talks showed how to earn more without losing your grip on risk.

- Anna Petrenko (Everstake) unpacked the changes after Ethereum’s Pectra upgrade. Native delegation is up, and protocols like Eigenlayer are changing how we restake. It’s opening new yield paths, but also new tradeoffs. Validators will need clearer strategies to avoid slashing and earn competitive rewards. Institutions especially need guidance on navigating this evolving terrain. These changes demand a new class of risk analysis tools tailored for institutional staking.

- Ray Orlev (Certora) raised the alarm: too much risk is getting piled into restaking layers. He pushed for better slashing rules and clearer limits. If we don’t manage it, the whole tower could wobble. Without accountability, the restaking ecosystem could recreate traditional financial contagion. This is a pressure point the industry can’t ignore. If left unchecked, restaking could become DeFi’s equivalent of 2008-style systemic exposure.

- Victor Charpiat (Spiko) introduced stablecoins that grow yield by default. You don’t have to do anything. Just hold, and it earns. It’s an elegant solution for passive crypto users who don’t want to manage DeFi positions. This could unlock adoption for people outside the crypto-native crowd. As these yield-bearing assets spread, expect pressure on traditional savings products to match their performance.

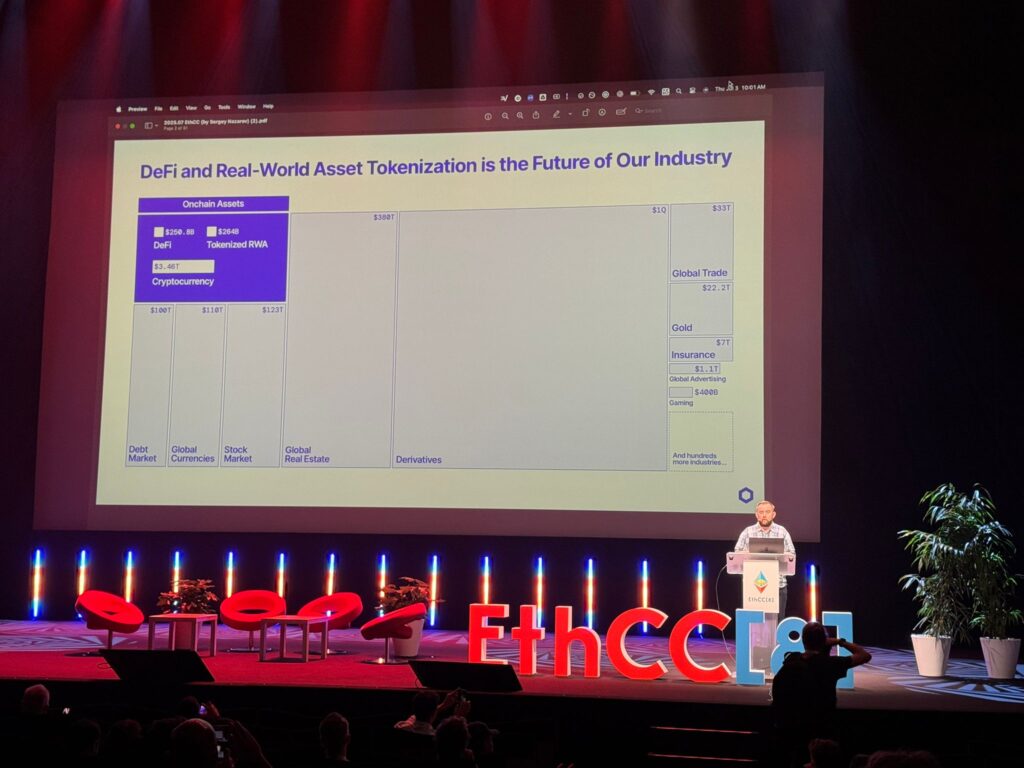

Sergey Nazarov (Chainlink) wants to simplify it all. He pitched a plug-and-play platform where staking, automation, and cross-chain tools live in one place. Developers can skip the glue code and focus on building applications. This may become the foundation for Ethereum’s modular service layer. For builders and users alike, it cuts complexity and saves time. It’s a long-overdue consolidation of the tooling mess DeFi has grown up with.

Cross-Chain, Rollups & Developer UX

Interoperability is messy. These speakers showed how to clean it up.

- Michael Messele (Etherspot) believes users shouldn’t need to know what chain they’re on. His vision? Wallets that route everything behind the scenes. It brings us closer to a seamless, chain-agnostic Web3 experience. That kind of frictionless design is key to mainstream adoption. If executed right, chains will feel as invisible as servers on the internet today.

- Kaven Choi (Etherscan / Blockscan) backed it up with a plan for a single multichain API. Build once, deploy anywhere. This standardization would cut development time and let protocols focus on core logic. It also lowers the barrier for new devs entering the space. It’s the first step toward making cross-chain apps as easy to build as single-chain ones.

- Antoine Sparenberg (Argent) showed how smart accounts are already abstracting gas fees and approvals. The result? Fewer clicks, smoother flow. Users feel like they’re using a mobile app, not navigating blockchain infrastructure. It’s the UX leap Web3 has been waiting for. This could be the final unlock for onboarding millions of users.

- Christoph Schlegel (Flashbots) made the case for smarter cross-chain arbitrage. Done right, it boosts liquidity and smooths out market swings. But it needs reliable bridges and real-time monitoring tools to work effectively. Execution is everything in these complex ecosystems. If tools lag, arbitrage fails—and users flee.

- Xin Wan (Uniswap Labs) nailed the bottom line: users follow simplicity. If the fees are clear and assets move fast, liquidity stays. Clunky UX is the main reason users abandon promising protocols. Make it seamless or lose them—it’s that simple. Every second of delay, every extra step is a reason for capital to walk away.

Security, Privacy & Risk Management

Security remains DeFi’s biggest headache. ETHCC didn’t sugarcoat it—and that’s a good thing.

- Matthias Egli (Chainsecurity, Rekt) broke down the biggest hacks since 2024. Weak permissions, broken oracles, and human error led the list. Lessons learned? Protocols must audit smarter and automate safety checks. The stakes are too high to treat security like an afterthought. Every failure has a ripple effect, often costing users millions. These breaches aren’t rare—they’re systemic, and we need to rethink how we test and monitor.

- Tincho & Matta (The Red Guild) launched “The Phishing Dojo” to help users spot scams by behavior, not just bad links. That shift could protect more wallets from getting drained. It marks a shift from passive defenses to proactive education. Instead of blocklists, we now need pattern recognition and user awareness. Training users to spot deception before it happens will save more than any patch.

- CvH (Polygon) gave an honest look at what it means to be a CISO. Burnout is real. And it’s putting entire systems at risk. Leaders need stronger peer support, clearer scopes, and better tooling. We need to stop glamorizing nonstop hustle and start valuing longevity. If your security lead burns out, your whole org is exposed.

- Charles Guillemet (Ledger) showed how simulating transactions before signing can stop costly mistakes. He urged every wallet to make this the default. It’s a simple fix that could save millions in user losses. Users don’t read hex strings—they need clear summaries. Simulations aren’t a luxury anymore; they’re a necessity.

- Maya Dotan (Starkware) reminded everyone: we still rely on Web2 tech like Gmail and DNS. Until we cut that cord, Web3 isn’t really safe. Attackers will keep using these weak points unless we shift to Web3-native comms and key systems. Dependency on centralized infra weakens decentralization. We must build native, encrypted alternatives before it’s too late.

- Pascal Tallarida (Jarvis Network) shared a DeFi-native risk score that updates live based on slashing and market moves. It’s like a credit score, but for protocols. Users can finally compare risk in real-time and move accordingly. Risk isn’t static—it evolves fast in DeFi. This tool brings transparency where there used to be guesswork.

Smart Accounts & Wallet Evolution

Wallets are finally catching up with what users actually need. Smart accounts are simplifying Web3 in ways that matter.

- Ryan McPeck (MetaMask) showed how users can now set time limits and rules on wallet permissions. It’s more control, less guesswork. These new features reduce risk for everyday users while giving power users more flexibility. It’s the kind of customization you expect from banking apps—finally available in crypto. Better permissions mean fewer accidents and more confidence.

- Antoine Sparenberg (Argent) shared real examples of sponsored gas and bundled actions. Users don’t even notice the complexity. It’s Web2 smoothness with Web3 control. This removes one of the biggest blockers to mainstream adoption: confusing flows. Now the tech fades into the background, and that’s the goal.

- 0xtanishk (Ithaca) said account abstraction is the bridge across rollups. With it, user flows can stay smooth even when the tech underneath is fragmented. That means less switching and more confidence in moving funds across layers. It’s like roaming for blockchains—your activity works, no matter where you are. This unlocks consistency in a fragmented ecosystem.

On-Chain Banking & Financial Applications

Web3 is getting closer to replacing your bank. And not just with better yield—with better access.

- Gabriel Gruber (Exa App) described a mobile-first future. Save, spend, and borrow without ever logging into a bank. These apps will serve people without access to traditional banking systems. For many, it’ll be their first experience with financial autonomy. The simplicity of Web2 with the power of Web3 could unlock new global markets.

- Arnaud Salomon (Mt Pelerin) wants to connect your self-custody wallet to the IBAN system. That makes it easier to pay and get paid globally. It also enables cross-border payments without relying on centralized rails. This bridge between crypto and traditional systems could finally make crypto usable day-to-day. It’s the kind of infrastructure shift that accelerates adoption at scale.

- Juan Mendieta (Keyrock) showed how on-chain asset management can give you full visibility into performance—no hidden fees, no waiting. Strategies are executed transparently with real-time metrics. Investors can see exactly where their funds are going. This kind of radical transparency is what traditional asset managers can’t offer. It makes trust optional—and that’s powerful.

- Paul Brody (EY) said enterprises care most about composability, not just privacy. Plug-and-play logic wins over siloed systems. If businesses can combine features like Lego blocks, they’ll adopt faster. Flexibility lowers integration costs and time to market. This modularity is how DeFi beats legacy stacks.

- Paul Frambot (Morpho Labs) sees DeFi becoming the invisible engine behind FinTech apps. You’ll use it without even realizing it. Compliance layers will make it indistinguishable from legacy finance, but faster. The infrastructure will matter, but the interface won’t. That’s when we know crypto has truly won.

Stablecoins, BTCfi & Censorship-Resistant Finance

The fight for stablecoin dominance is heating up. And Bitcoin-backed finance is finally stepping forward.

- Gaspard Peduzzi (Spectra) explained why new stablecoins are trying to beat Tether—with better collateral, privacy, and yield mechanics. He broke down each contender’s angle, from decentralized minting to native yield generation. The stablecoin market is now a battle for trust and utility. Success will come to the one that blends usability with resilience. Peduzzi argued that the future of finance will depend on stablecoins that users don’t need to think twice about holding.

- Scott Piriou (bitUSD) introduced an interest-bearing BTC stablecoin that works on BitVM. No middlemen, no trust assumptions. It’s a big step toward making Bitcoin programmable without bridges. If it scales, it could reshape Bitcoin’s role in DeFi. This innovation could finally turn Bitcoin from a passive asset into an active financial tool.

- Rena Shah (Stacks) made it clear: BTCfi is real and it’s big. Bitcoin can now be used for remittances, collateral, and passive yield. It’s no longer just digital gold—it’s a productive asset in the DeFi stack. This turns Bitcoin from a store of value into a source of yield. As BTCfi grows, it may even challenge Ethereum’s dominance in decentralized finance.

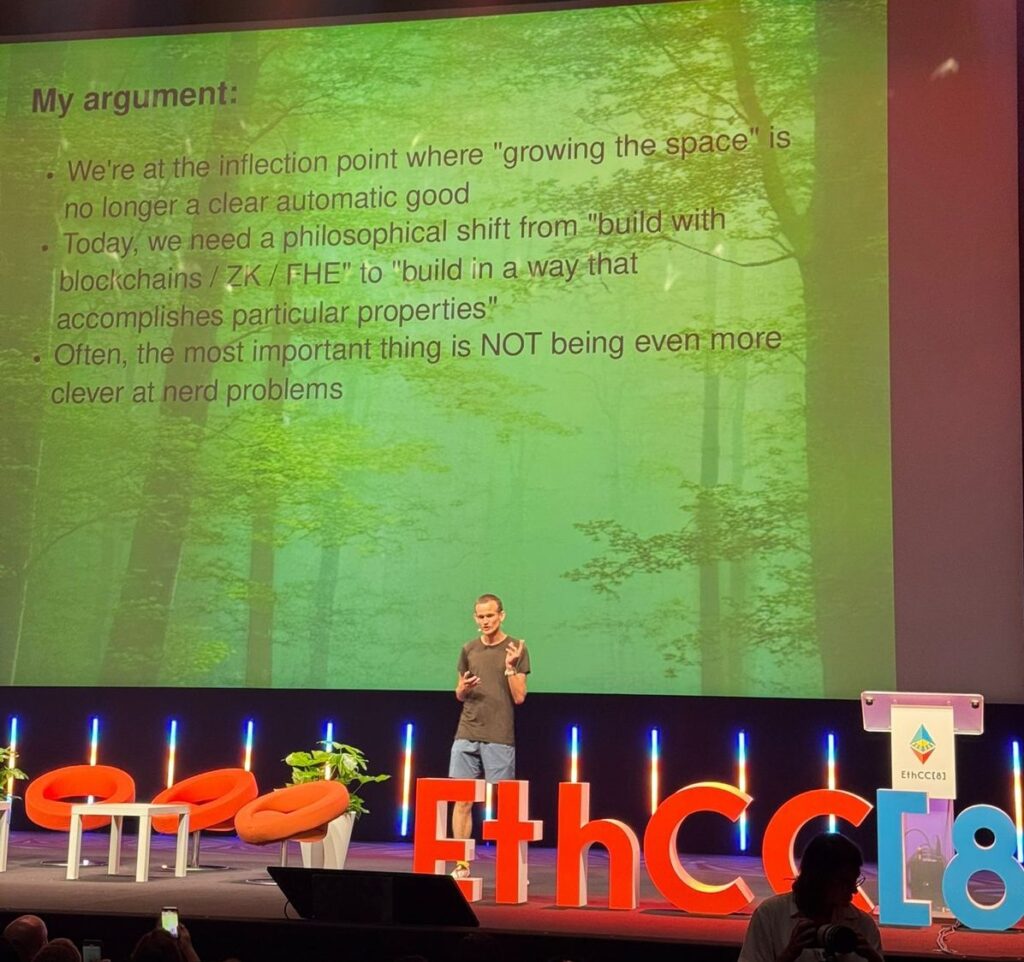

Vitalik Buterin: Ethereum’s Next Era

Vitalik Buterin’s talk at ETHCC 2025 was a reset button—a reminder of what Ethereum is and where it needs to go next. Rather than presenting new tech, he focused on core values and challenges that are resurfacing as Ethereum grows.

His main point? Ethereum needs to stay useful and intuitive. Right now, the user experience is too clunky and fragmented. Vitalik urged the ecosystem to stop chasing every new feature and instead make existing tools simpler and more secure.

He emphasized the need to double down on account abstraction, privacy-preserving tech, and better wallet recovery methods. He also made it clear that layer-2 fragmentation is a real problem. The chain may scale, but if users get lost in the process, we all lose.

What’s new is the tone: Vitalik sounded more urgent, more focused. He called for pragmatic coordination, not just idealistic innovation. He reminded the audience that Ethereum isn’t a tech demo—it’s a live system carrying real value and real people.

The message was clear: slow down, clean up, and ship things that users can actually use. That’s how Ethereum wins.

CRYSTEP’s Take

We see ETHCC 2025 as a turning point. From AI agents managing smart accounts to the rise of Bitcoin-based DeFi, the tools and philosophies we’ve built CRYSTEP around are becoming foundational. The conversations confirmed a growing demand for secure asset supervision, simplified interfaces, and privacy-first automation—principles we already operate on.

As new technologies like ERC-4337, AI-native finance bots, and programmable stablecoins evolve, our mission is clearer than ever: to give high-net-worth individuals and institutions peace of mind in a landscape that’s getting smarter, faster, and riskier. We’re building not just to keep up, but to lead in security, autonomy, and client-first innovation.